CASE STUDY

Strategic planning for an investment fund

What to consider

Introduction and Client Context

Illinois Ventures (IV), is a venture capital fund housed within the University of Illinois ecosystem that was set up in 2000 with the specific mandate of supporting cutting-edge innovations emerging from (but not limited to) the University community.

IV had successfully launched and deployed capital across three funds. However, the organization had observed significant evolution in the broader venture fund market, had brought on new executive leadership, and was grappling with questions about the appropriate vision, role, and scale of future funds given its distinct position in a university ecosystem. IV’s board and leadership sought outside help to identify what the organization could focus on that would make it distinct from others, contribute meaningfully to the university and its stakeholders, and maximize the likelihood of success in raising funds, making investments, and generating returns. In addition, some stakeholders wanted to explore whether and how to incorporate an impact investing lens—with either social and/or environmental objectives—into the fund’s priorities.

Challenge

In preparation for the launch of the fund, Illinois Ventures required support answering three key questions:

- Goals: What is the mission and vision of the new fund?

- Strategy: What should be our fundraising approach?

- Implementation: What are the different components of our implementation plan?

The client was keen on co-developing the answers to these questions, and to build internal consensus through this design process.

Our approach

The Cicero team was brought in to support Andrew Allen, the assistant dean of the business school at the University of Illinois Urbana-Champaign, who had developed the relationship and led the work with IV. Together, the team facilitated the strategic planning process of the new fund in order build board-level alignment on the fund’s objectives and approach. The team conducted a landscape exercise of other university venture funds to understand the state of the market, and to identify opportunity areas where IV investments could offer additionality. This was supplemented by primary research with students to better understand Illinois Ventures’ strategic positioning. This research fed into the preparation and facilitation of two workshops with the board and supporting conversations with individual board members to determine a new strategic direction for Illinois Ventures. Insights from this process were synthesized into a milestone-based implementation plan and a framework to guide the next stage of fund set-up.

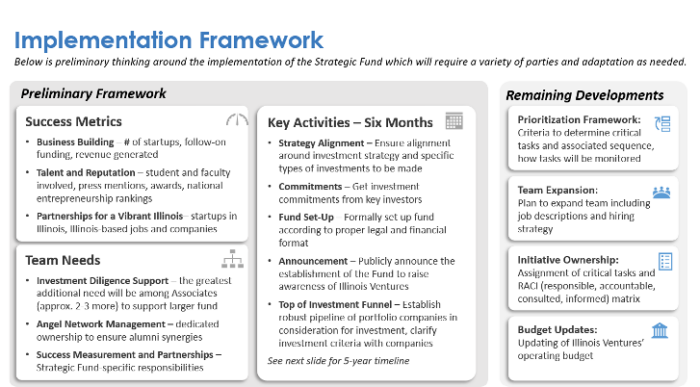

Figure 1: A draft implementation framework presented to the board to receive inputs in a co-development workshop

Results

Illinois Ventures leadership team participated actively in the brainstorming and design process we facilitated. This collaborative process yielded diverse set of insights from team debate and discussion facilitated by Cicero, and eventually, an agreement on the vision, mission and path forward amongst the internal team. Cicero synthesized inputs into a clear action plan with, timelines and milestones for the next phase of work. These materials are informing Illinois Ventures future fundraising efforts.

Start a Conversation

Thank you for your interest in Cicero Group. Please select from the options below to get in touch with us.