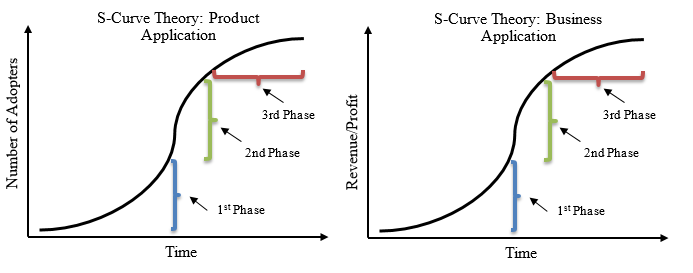

A Primer on S-Curves

S-Curve Theory has been used to model either the success of a new product released into the market or the performance – as measured by revenue or profit – of a business over time. In regards to a new product released into the market, S-Curve Theory predicts that the performance of a new product, if successful, follows the shape of an S over time. That is, in a product’s early years, it gains adopters slowly (1st Phase). However, if successful after this initial phase, the rate of adoption increases dramatically, leading to steep growth in the number of adopters (2nd Phase). After achieving market saturation, the rate of adoption begins to decrease and the total number of adopters begins to plateau (3rd Phase). In regards to business performance, S-Curve theory states that a business sustains slow growth at first (1st Phase), followed by rapid growth (2nd Phase), and finally with declining growth that plateaus (3rd Phase).

S-Curve theory is helpful because it provides a lens through which companies can view their likely potential. Companies that use S-Curve Theory to identify their likely position on the S-Curve can be better informed about their future performance. Successful companies are able to search for and identify new opportunities for growth after realizing their current business models have stagnating or declining growth on the horizon. Identifying and acting upon new opportunities for growth is a difficult art as it often needs to occur while the current business is still performing well and there may not be clear signs of declining growth in the future. To further complicate matters, as business leaders seek prescient identification of new growth opportunities, they must be careful not to lose focus on performance and efficiency of the current business model.

Due to the difficulty of successfully moving to new opportunities for growth – also referred to as jumping S-Curves – it is not surprising that many, if not most companies fail to do so. Blockbuster’s failure to identify and act upon the Netflix threat in time led to swift bankruptcy. Blackberry’s arrogance after achieving over 50% of the smartphone market share in 2007 blinded it to the threats posed by upcoming smartphones, including the Apple and Samsung lines. Today, nine years later, Blackberry retains a mere .8% market share.

Despite the difficulty, some companies have found success jumping S-Curves. UPS successfully jumped S-Curves multiple times when it moved from a messenger service to a business delivery service, and ultimately to a public parcel delivery service. Apple, after Steve Jobs returned in 1997, narrowly escaped bankruptcy and has since grown to be the world’s cutting-edge technology company by changing its focus from profitability to quality of products. This subtle shift in focus led to the creation of revolutionary products – iPod, iPhone, and iPad – that have propelled Apple’s S-Curve jumps.

Jumping S-Curves is no simple task, but a solid understanding and application of S-Curve Theory can better inform companies seeking to sustain long-term growth.

Start a Conversation

Thank you for your interest in Cicero Group. Please select from the options below to get in touch with us.